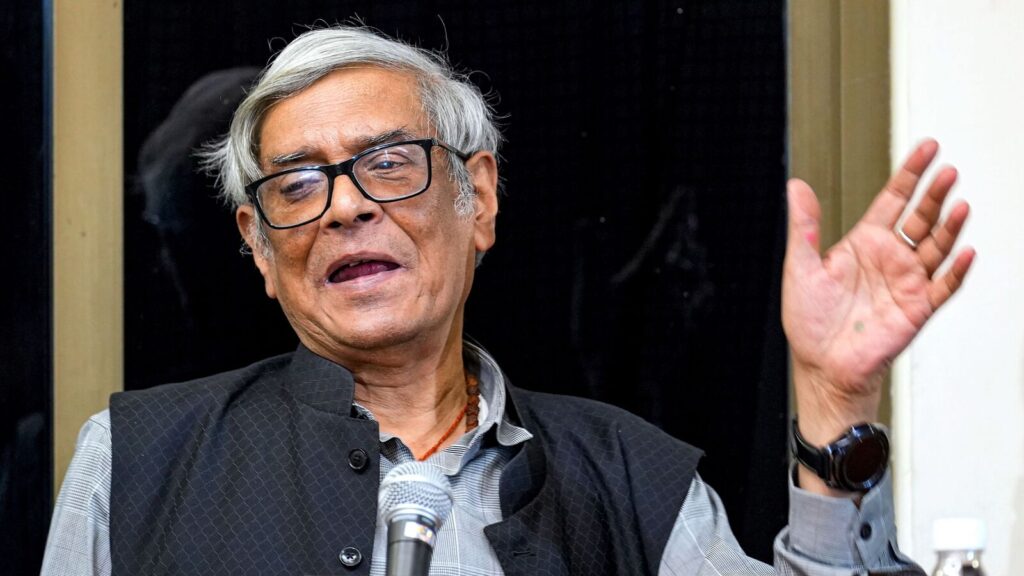

Debroy panel finalizes infra investment roadmap; Report due in May

New Delhi: A high-level committee set up by the central government has finalized key measures to boost infrastructure investment, including attracting foreign funds, promoting corporate bond finance, building specialized infrastructure funds, and creating a fresh pipeline of public-private partnership (PPP) projects, two people familiar with the matter told Mint.

The panel, formerly headed by Bibek Debroy, chair of the economic advisory council to the Prime Minister, will release the final part of its report in May, supporting India’s infrastructure growth amid global headwinds, said the people mentioned above.

The report will likely guide policymaking as the government sustains its capital expenditure push in FY26—a crucial growth driver in an uncertain global environment.

“The proposed financing framework will serve as a benchmark for central ministries and states as they shape their infrastructure road maps over the next two to three years,” one of the two people mentioned above said, requesting anonymity.

“A clear framework will be key to attracting private investment and aligning funding across central and state initiatives,” the person added.

The finance ministry established the committee in 2023, under the chairmanship of the late economist Debroy, to assess infrastructure requirements and develop a financing framework.

The panel held wide-ranging stakeholder consultations before finalizing its recommendations.

The first part of the report, already submitted by the committee, outlined new definitions and expanded the scope of infrastructure activities, while the second part lays out the framework for public and private financing, the second person mentioned above said.

“The report, slated to be submitted to the government next month, is unlikely to be made public,” the person added.

A spokesperson for the finance ministry did not respond to emailed queries.

Anticipated Recommendations

As things stand, sovereign wealth fund investments in India’s infrastructure remain tax-free until 2030, with the Debroy committee likely to propose extending this to other foreign funds, including pension funds.

The committee also aims to promote corporate bond financing.

To be sure, the budget has already proposed a partial credit enhancement facility for infrastructure bonds through NaBFID.

NIIF (National Investment and Infrastructure Fund) also offers this service, but at a limited scale.

However, financing large-scale, privately operated projects remains difficult due to long timelines and land acquisition issues.

The World Bank estimates India needs $840 billion in urban infrastructure investment by 2037, with private funds covering only 5% of the need.

With government investment peaking, private capital is crucial to filling the gap.

The Union budget has also tasked ministries with creating a three-year pipeline of PPP projects.

The Debroy committee report is expected to present a framework for PPP financing.

“The committee has reviewed financing strategies for sectors like roads, railways, and ports, evaluating the best approaches for public and private investment,” said the first person mentioned above.

Tariff challenges

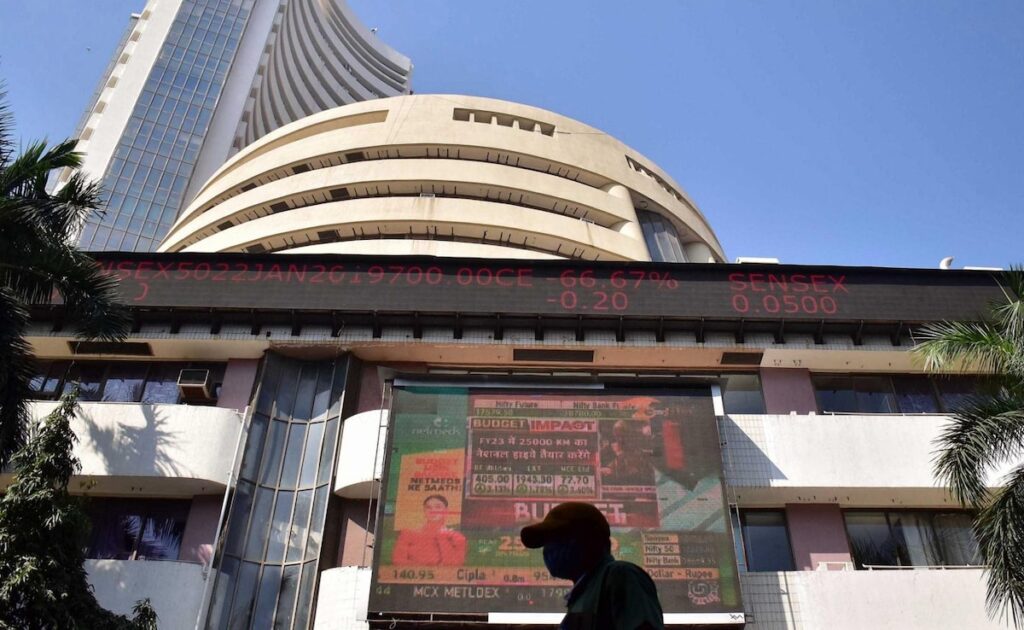

Meanwhile, the central government will continue its public capex spending to power growth amid downside risks from the US reciprocal tariffs.

The government’s capital expenditure (capex) for the fiscal year 2025 (FY25) is poised to meet—and even modestly exceed—the revised target of ₹10.2 trillion, supported by an accelerated deployment of funds in the latter half of the fiscal year.

Developing key infrastructure development, some in partnership with the private sector will be key to the country’s economic growth.

India’s economic growth is expected to remain resilient during FY26, supported by sustained government spending and a potential revival in private investments, rating agencies said in their FY25 rating assessments released recently but warned of risks to exports from escalating US tariffs and a widening trade war.

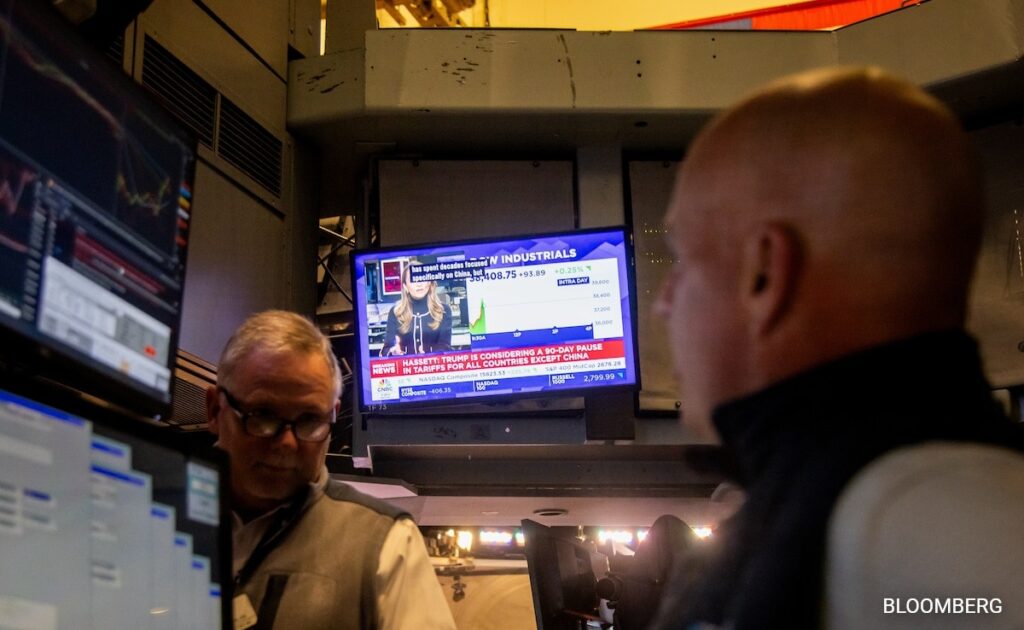

India Ratings & Research, a Fitch Group company, said it expects the economy to grow at 6.6% in FY26, but warned that rating actions could moderate during the fiscal year.

Recently, Moody’s Analytics trimmed its calendar year (CY) 2025 growth forecast for India to 6.1%, lowering it by 30 basis points from its March projection, in response to US tariffs.